hawaii tax id number 12 digits

Or by calling 800 222-3229. Through Hawaii Business Express individuals can file Form BB-1 so they can earn their ID.

What Do I Need To Enroll In Autofile For Hawaii Taxjar Support

How Do I Get A Tax Id Number In Hawaii.

. Use this search engine to find the latest Hawaii Tax ID numbers for Cigarette and Tobacco Fuel General Excise Sellers. Hawaii tax id number 12 digits. 0000000000 10 digits Hawaii Contribution Rate.

W99999999-01 Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. 3 rows Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format. Individuals can register online to receive their ID by filing Form BB-1 through Hawaii Business Express.

A wholesale License is a sales tax ID number. Uses of Hawaii Tax ID EIN Numbers. 10 digits follow it.

GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type. The Department of Taxation DOTAX has many electronic services e-services that allow you to self-serve on Hawaii Tax Online. Tax IDs for Hawaii were issued prior to the modernization project with the message W.

The GE account type stands for General ExciseUse and County Surcharge Tax. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type. Tax Services Hawaiʻi Tax Online.

The Hawaii Tax ID starts with a two-letter account type identifier followed by 12 digits. You can find information about Hawaii Tax ID numbers by selecting either items 12 19 in the Tax Facts edition. Personal Information includes without limitation.

The sales tax IDs issued following the modernization project begin with the letter GE and carry a 12 digit number. 2 Financial Data such as Your creditdebit card number and expiration date. See Hawaii Tax ID Number Changes for more information.

Apply for a Hawaii Tax ID by Phone Mail or Fax. It is an alphanumeric number that is 10 digits. Even for businesses and entities that are not required to obtain a Tax ID EIN in Hawaii obtaining is suggested as it can help protect the personal information of the.

The GE account type stands for General ExciseUse and County Surcharge Tax. Apply for a Hawaii Tax ID Number. Individuals can register online to receive their.

Hawaii Withholding Account Number. Hawaii UI Account Number. Hawaii Department of Taxation.

Obtaining a Hawaii Tax ID EIN is a process that most businesses Trusts Estates Non-Profits and Church organizations need to complete. You can make your reference to w99999999-01 on the w99999999-01 section. The newly awarded Hawaii SalesTax IDs begin with the letter GE and are followed by twelve digits after an amendment to the sales tax code was made.

Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation. Once youre done with the application you should receive your tax ID via email in an hour or less. The Tax ID or EIN serves as a way to easily identify the entity similar to how a Social Security Number is used to uniquely identify individuals.

Its the unique identification number assigned to each Hawaii tax account. You should not enroll in AutoFile using a Hawaii Tax ID that begin with abbreviations for other tax types such as CO. A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding.

While it is referred sometimes as an Employer ID Number the EIN is used by businesses and other entities to identify the tax accounts of both employers as well as other entities that have no employees. The IDs were supposed to be mailed to you last year. You can also look up the new one here httpshitaxhawaiigov_ Just enter the old ID you have Taxpayer name as listed on the.

Those Tax Identification Numbers or TINs issued before the modernization project begin with the letter W and end with ten digits in alphabetical order. You should not enroll in autofile using a hawaii tax id that begin with abbreviations for other tax types such as co fr gs ps rv ta or wh. Tax accounts that have been upgraded will be distinguished by a new Hawaii Tax ID starting with a two-letter account type identifier and 12 digits.

Its the unique identification number assigned to each Hawaii tax account. Hawaii Withholding ID numbers are WH-00-000-000-0000-01 or -02. To get the tax ID of employers with payroll records in Hawaii in the past call 800- 222-3229 or find it on a notice received from the Hawaii Department of Taxation.

Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number for your personal income tax. 3 Business Data such as the name of your corporation or limited liability company LLC the. The state of Hawaii began a new process in 2017 that now requires a 12 digit business ID number.

Even though applying online is universally the best application method there are some other methods to choose from. The Hawaii Tax ID starts with a two-letter account type identifier followed by 12 digits. Check sum with the following weighting coefficients is calculated.

1 Contact Data such as Your name phone number fax number mailing address and e-mail address. Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. Where can I look up my Hawaii Tax ID.

Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. WH-000-000-0000-01 or -02 has been assigned to Hawaii Withholding ID numbers. A Hawaii tax id number can be one of two state tax ID numbers.

As a result of running payroll through Hawaii for the past two years employers or businesses that use the Hawaii Department of Taxation can locate their tax identification by reading their notices including the Withholding Tax Return Form HW-14. This is different from a Social Security number SSN or employer identification number EIN. If you did not get the mailer you can contact taxpayer services in the link below.

Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number for your personal income tax. XX Hawaii Employment and Training Assessment Rate. Get Answers to your 2021 Tax Year Questions deadline estimated taxes unemployment compensation PPP Search DOTAX Website.

A Hawaii tax id number can be one of two state tax ID numbers. Hawaii Tax IDs that were issued prior to the modernization project begin with the letter W and are followed by 10 digits. A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding.

Table of contents how do i find my hawaii tax id. Apply for a Hawaii Tax ID Number. WH-000-000-0000-00 WH 12 digits Hawaii Department of Labor and Industrial Relations.

How Many Numbers In Hawaii Get Tax Id Kauai Hawaii

3 21 111 Chapter Three And Chapter Four Withholding Returns Internal Revenue Service

3 21 111 Chapter Three And Chapter Four Withholding Returns Internal Revenue Service

Tax Preperation On Oahu Executive Accounting Solutions

Form Ta 1 Download Fillable Pdf Or Fill Online Transient Accommodations Tax Return Hawaii Templateroller

How Many Digit Is Hawaii Tax Id Kauai Hawaii

3 24 38 Bmf General Instructions Internal Revenue Service

3 21 110 Processing Form 1042 Withholding Returns Internal Revenue Service

3 21 110 Processing Form 1042 Withholding Returns Internal Revenue Service

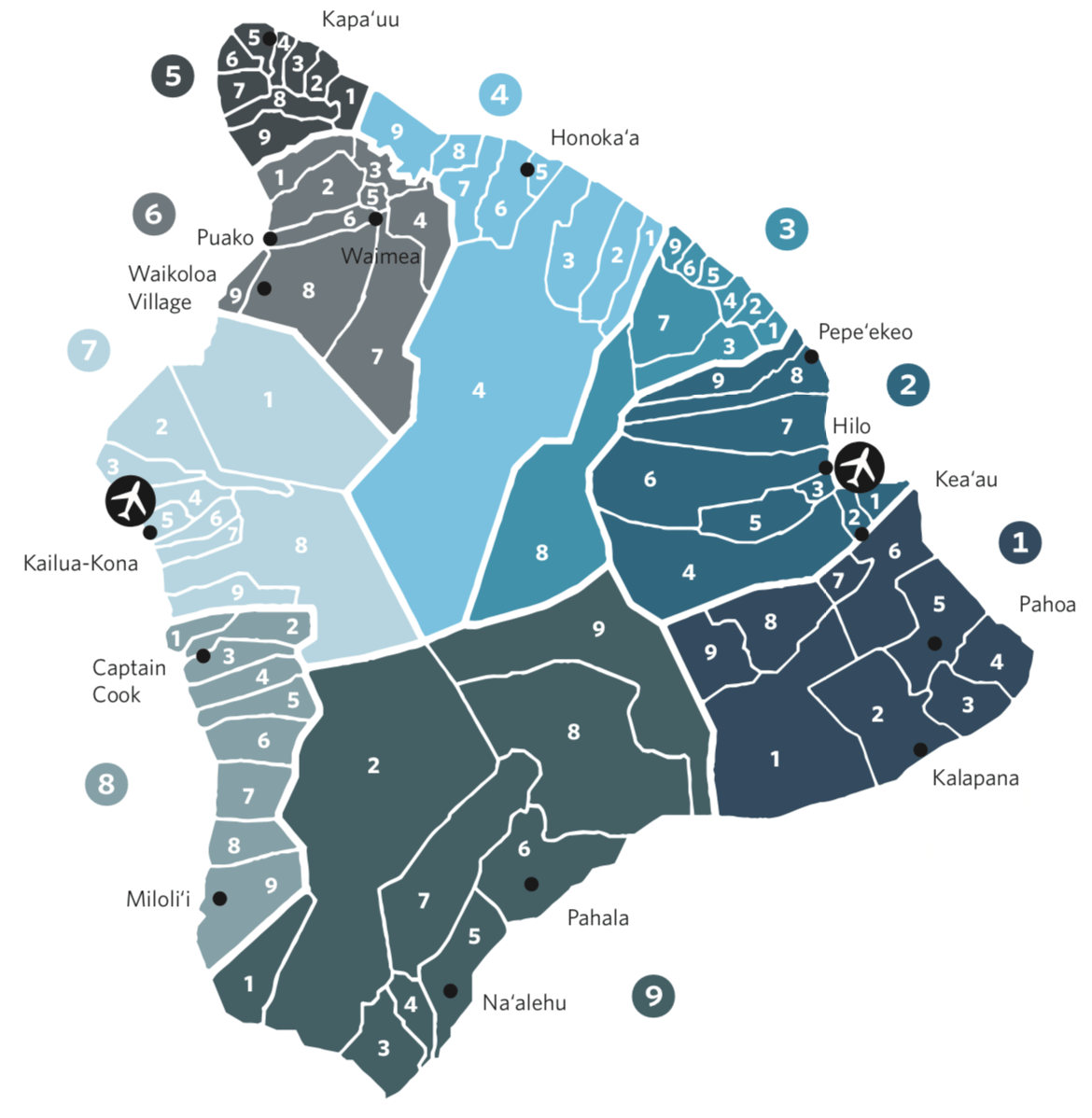

How Hawaii Addresses Its Properties Hawaii Real Estate Market Trends Hawaii Life